NGO Registration

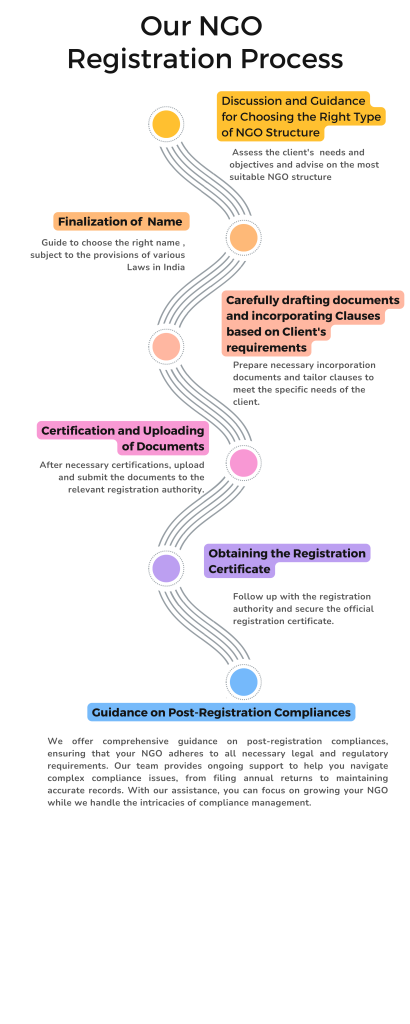

Starting an NGO is a noble venture that requires careful planning and adherence to legal regulations. Our comprehensive NGO registration service is designed to simplify this process for you. We guide you through every step, from selecting a suitable name and drafting the necessary documents to submitting your application to the appropriate authorities. With our expert assistance, you can focus on your mission to make a positive impact while we handle the complexities of legal compliance. Our service ensures that your NGO is legally recognized and fully equipped to operate, giving you the confidence to start your charitable activities without any administrative hurdles.

Choosing our NGO registration service means you are partnering with professionals who understand the intricacies of the registration process. We offer tailored solutions to meet your specific needs, whether you are forming a trust, society, or section 8 company. Our team stays updated with the latest legal requirements and procedures, ensuring that your registration is completed swiftly and accurately. Additionally, we provide post-registration support to help you navigate ongoing compliance and reporting obligations. Trust us to pave the way for your NGO’s success, allowing you to dedicate your efforts to driving social change and making a difference in the community.

A Section 8 Company is a non-profit organization registered under the Companies Act, 2013, with the objective of promoting commerce, art, science, sports, education, research, social welfare, religion, charity, or protection of the environment.

Faq Content #2

1. A minimum of two directors.

2. No minimum capital requirement.

3. No minimum capital requirement.

4. Objectives should be charitable or non-profit in nature.

Yes, a Section 8 Company can be converted into a Private or Public Limited Company, subject to compliance with the Companies Act, 2013.

Yes, a Section 8 Company requires a special license from the Registrar of Companies (RoC) after submission of relevant documents and forms.

Yes, a Section 8 Company can have foreign directors, subject to compliance with FEMA regulations and other applicable laws.

Yes, Section 8 Companies can avail tax benefits under Section 12A and 80G of the Income Tax Act, 1961

The process involves a resolution passed by the Board, an application to the National Company Law Tribunal (NCLT), and compliance with all legal requirements.

A Public Charitable Trust is an organization created by a settlor (founder) to provide benefits to the public or a section of the public in areas like education, healthcare, relief of poverty, etc.

A Trust is governed by the Indian Trusts Act, 1882, and is generally easier to set up with fewer compliance requirements. A Section 8 Company is regulated under the Companies Act, 2013, with more stringent compliance norms.

At least two trustees are required, although there is no upper limit.

Yes, a Trust can own property in its name, and the trustees manage it for the benefit of the beneficiaries.

Yes, Public Charitable Trusts can avail tax exemptions under Section 12A and 80G of the Income Tax Act, 1961, provided they comply with the relevant provisions.

Yes, but only if the commercial activities are incidental to the main objectives of the Trust and the profits are used solely for charitable purposes.

A Trust can be dissolved according to the terms laid out in the trust deed, or by mutual agreement of the trustees, with the assets being transferred to another trust with similar objectives.

A Society is a group of individuals who come together to promote a common cause, such as cultural, scientific, literary, or charitable activities, registered under the Societies Registration Act, 1860.

A minimum of seven members is required to form a Society.

Yes, a Society can be registered at the state or national level, depending on the scope of its activities

Registration provides legal status, which allows the Society to own property, sue or be sued, and access government grants and tax exemptions.

A Society can be dissolved by a resolution passed by its members, followed by settling all debts and liabilities, and transferring the remaining assets to another society with similar objectives.

Society

Lorem Ipsum Dolor Sit Amet Consectetur. Posuere Purus Maecenas Quam In Vestib Elit Orci. Urna Sapien₹35,000/Monthly

- Stamp Duty

- By-law drafting

- Government Fees

- Deed Drafting

- Registration

- 12 A Registration

- 80 G Registration

- Bank Account Opening Support

Trust

Lorem Ipsum Dolor Sit Amet Consectetur. Posuere Purus Maecenas Quam In Vestib Elit Orci. Urna Sapien₹35,000/Monthly

- Stamp Duty

- Government Fees

- Deed Drafting

- Registration

- 12 A Registration

- 80 G Registration

- Bank Account Opening Support

Section 8 Company

Lorem Ipsum Dolor Sit Amet Consectetur. Posuere Purus Maecenas Quam In Vestib Elit Orci. Urna Sapien₹26,000/Monthly

- Name Reservation

- Company Registration

- Stamp Duty

- 2 Digital Signatures

- 2 DIN

- MOA and AOA

- PAN and TAN

- Bank Account Opening Support

NGO Registration enables the promoters to legalize the charitable activities, they are doing or intending to do. In India NGO Registration can be done as a Trust or Society or Non Profit Company. NGO’s or Non Governmental Organisations or Non Profit Organizations are a group of volunteers/ people Joined together for social and charitable activities, for the welfare of the Public and society. NGO’s play a vital role in the up-lifting of our Country, especially in rural areas and villages. They provide or assists to provide an improved way of life in a sustainable manner. There is no specific legislation for NGO Registration, but different laws govern it based on the type of NGO’s

NGO’s are free to receive funds, including foreign funds, Government assistance, CSR Funds and donations for the fulfillment of their objectives. NGO’s also can act as implementing agencies for various government schemes. Globally there are are many NGO’s implementing World Bank Schemes, WHO Schemes, IMF Schemes etc, for the welfare of the People

In India NGO’s can be registered as Private Trust, Public Trust, Society and Section 8 /Non Profit Company

No post Found